There is nothing more troublesome than being unable to use your credit or debit card while on vacation. Nobody wants to travel around with cash, it is not only inconvenient, it is also dangerous. Revolut provides an easy and low-cost financial solution for travelers.

Revolut was first launched in 2015 and since then has become the preferred digital financial platform for several million users.

Armed with several features combined with its easy-to-use app and free services, it is no wonder that the app has so many users.

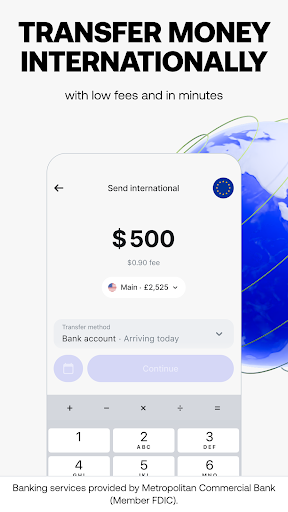

Revolut doesn’t just offer a convenient way to access your funds when abroad, it has also become the preferred option when sending money overseas.

But, what is it that makes Revolut so popular among users, and is it just a hype? We take a detailed look at the features and the experiences of other users to let you decide whether the app is worth your time.

A brief overview of Revolut

The first thing to note about Revolut is that it is not a bank. That might be a bit difficult to take in, mostly because you can send and receive money via Revolut. Also, most banks now have digital operations. So, it can be difficult to distinguish between regular banks and Revolut.

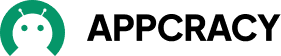

Yes, you can open an account with Revolut and get an account number. You can send, receive and save money with the app. However, what differentiates it from other bank apps is that Revolut is fully digital, with its services available on the app.

Also, with Revolut, you cannot operate a credit card. What you have is a prepaid debit card. Thus, if you don’t have money in your Revolut account, your card will not work for you. You’ll need to fund the card to use it.

Features of the app

- Easy account opening

Opening an account with Revolut is as simple as downloading the app. The app is available on the Google Play Store and the Apple App Store. Alternatively, you could go to the end of this review and click on the download link.

Once you have the app, you would need to provide a valid house address and phone number, and you’re set to go. Also, you can open different account types with the app.

Create accounts with multiple currencies, earn money with a savings account, or open a business account. There are also options for joint accounts and an account for ages 6 to 17.

- Instant transfers

You can send instant transfers to those in your contact list who have Revolut accounts. Alternatively, all you need is the receiver’s account details, and you can send funds to 150+ countries.

Best of all, funds transferred are instant. There’s usually no waiting period when you use Revolut.

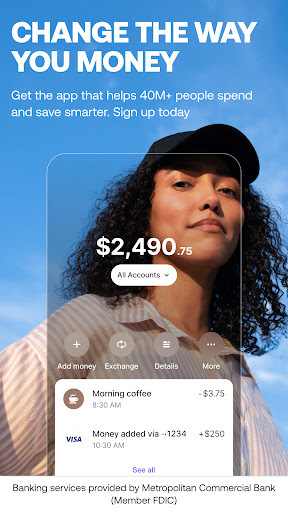

- Prepaid debit cards

Users are entitled to one physical prepaid debit card with a free account. If you upgrade to a platinum user, you can order more cards.

There are virtual cards that you can use, and you can create a disposable debit card through the app for one-time payments.

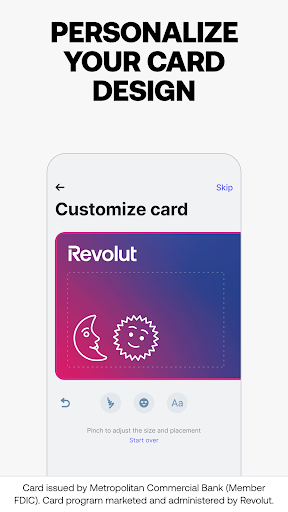

- Pockets for savings

You can move funds to special pockets for savings. While you can access your funds at any time, they will be inaccessible for payments billed to your card unless you move the funds back to the main account.

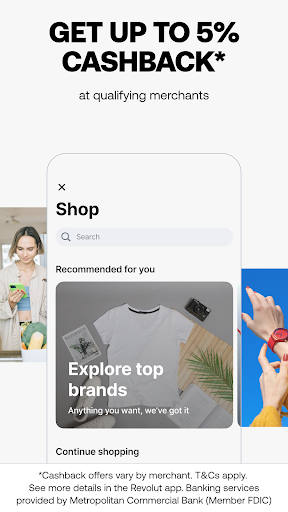

- Investment options

You can buy shares, cryptocurrency and also explore other investment vehicles with just a few taps.

Revolut Versus other Apps

Revolut is not the only option for your digital financial needs. There are apps like Monzo, which is a bank. If you are after simple banking services that provide overdraft facilities and access to a credit card, then you should pick Monzo over Revolut.

Again, there are other apps you can choose from if all you have to do is transfer funds. Apps like Wise, Remitly or World Remit provide versatile features for money transfers.

The advantage of Revolut is that you can enjoy the convenience of a bank account, own a debit card and enjoy free transfers with zero stress.